Understanding Fraud and Money Laundering: Mechanisms and Preventive Measures

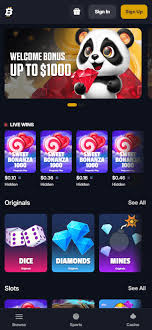

Fraud and money laundering have emerged as significant threats to global financial stability and integrity. In modern times, these financial crimes have evolved with technology, making them more complex and harder to detect. This article explores the mechanisms of fraud and money laundering, the methods used by criminals, and the steps that can be taken to combat these illegal activities. A relevant resource that sheds light on various facets of financial transactions can be found at Fraud and Money Laundering Through Crypto Casinos Bitfortune com.

The Nature of Fraud

Fraud refers to deceptive practices aimed at securing unfair or unlawful gain. It can take many forms, including identity theft, credit card fraud, and investment scams. Often, fraud is committed by individuals or groups exploiting loopholes in financial systems. The digital age has exacerbated these issues, providing criminals with a broader arena to operate in and more sophisticated tools to use.

Types of Fraud

- Identity Theft: Stealing personal information to access financial resources.

- Credit Card Fraud: Unauthorized use of someone’s credit card details.

- Investment Scams: Misleading investors to sink money into fraudulent schemes.

Understanding Money Laundering

Money laundering is the process of disguising the origins of illegally obtained money, making it appear legitimate. This crime often follows three stages: placement, layering, and integration. The ultimate goal is to make the money untraceable to criminal activities.

The Three Stages of Money Laundering

- Placement: Introducing illicit funds into the financial system.

- Layering: Concealing the source of the funds through a series of complex transactions.

- Integration: Restoring the laundered money into the economy, making it appear as legitimate income.

Common Techniques Used in Money Laundering

Criminals utilize various techniques to launder money, often taking advantage of the complexity of financial systems. Here are some common methods:

- Structuring: Breaking down large amounts of cash into smaller, less suspicious amounts.

- Trade-Based Money Laundering: Over- or under-invoicing for goods to move money across borders.

- Shell Companies: Creating fake businesses to disguise illegal transactions.

The Impact of Fraud and Money Laundering

The implications of fraud and money laundering extend far beyond individual victims. These crimes can damage reputations, disrupt economies, and pose significant risks to financial systems. In addition to the immediate financial losses, businesses may face regulatory penalties, damaging lawsuits, and irreparable harm to their credibility.

Preventive Measures and Regulations

Combatting fraud and money laundering requires a multifaceted approach involving technology, regulatory frameworks, and education. Here are some key measures:

1. Implementing Robust Anti-Fraud Systems

Financial institutions and businesses should invest in advanced technological solutions that leverage artificial intelligence and machine learning algorithms to identify unusual patterns in transactions. These systems can significantly reduce the incidence of fraudulent activities.

2. Employee Training

Regular training sessions for employees on recognizing the signs of fraud and money laundering are crucial. An informed workforce can act as the first line of defense against financial criminals.

3. Regulatory Compliance

Adhering to regulatory mandates, such as the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, can help organizations protect themselves from potential risks associated with financial crime.

4. Collaboration with Law Enforcement

Financial institutions should actively collaborate with law enforcement agencies to share intelligence and report suspicious activities. Public-private partnerships can enhance the effectiveness of combating financial crime.

Conclusion

Fraud and money laundering pose serious challenges to individuals and organizations worldwide. As crimes evolve, so must our strategies for prevention and detection. By understanding the mechanisms behind these activities and implementing effective measures, we can work towards a safer, more secure financial environment. Awareness, education, and collaboration will play vital roles in combating these pervasive threats.