In today’s fast-paced financial environment, forex trading mobile app trading-ph.com mobile apps have transformed the landscape of currency trading, making it more accessible than ever before. With the advancement of technology and the proliferation of smartphones, traders can engage in forex trading at any time and from anywhere. This article delves into the key features, advantages, and potential challenges of forex trading mobile apps, highlighting their impact on both novice and experienced traders.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in a decentralized market. It is one of the largest and most liquid financial markets globally, with a daily trading volume exceeding $6 trillion. Unlike the stock market, the forex market operates 24 hours a day, five days a week, making it particularly appealing to those who wish to engage in trading outside of conventional working hours.

The Evolution of Trading Apps

Traditionally, forex trading was confined to desktop platforms, requiring traders to be stationed at their computers to monitor the markets and execute trades. However, the advent of mobile technology has revolutionized the way traders operate. Forex trading mobile apps combine functionality with portability, allowing users to make trades, analyze market trends, and manage their accounts on the go. These apps are designed to provide real-time data, advanced charting tools, and intuitive interfaces that are user-friendly, even for beginners.

Key Features of Forex Trading Mobile Apps

1. **User-Friendly Interface**: Most mobile trading apps boast an intuitive design, which simplifies navigation and enhances user experience. Traders can quickly access essential features, such as placing orders and reviewing their portfolio.

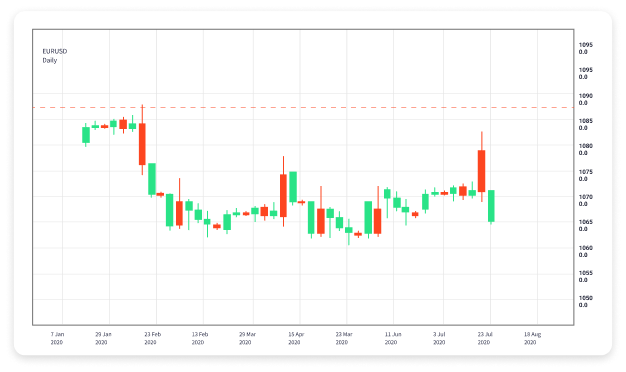

2. **Real-Time Market Data**: Mobile apps deliver real-time market quotes and price movements, ensuring that traders have the most current information at their fingertips. This is crucial for making informed trading decisions and seizing opportunities as they arise.

3. **Technical Analysis Tools**: Many apps come equipped with technical analysis tools and indicators, such as moving averages, RSI, and Fibonacci retracements, allowing traders to conduct thorough market analysis directly from their devices.

4. **News and Economic Calendars**: Accessible news feeds and economic calendars within trading apps keep users updated on market-moving events, helping them anticipate price changes and adjust their strategies accordingly.

5. **Secure Transactions**: Mobile trading apps prioritize security with encrypted transactions, ensuring that users’ data and funds are protected. Biometric authentication, such as fingerprint recognition, adds an extra layer of security.

6. **Widgets and Notifications**: Most apps allow users to customize their dashboards with widgets and real-time notifications, ensuring they never miss important market updates or price alerts.

Benefits of Using Forex Trading Mobile Apps

The benefits of forex trading mobile apps are numerous, making them an attractive choice for traders of all levels:

1. **Accessibility**: The primary advantage of using a mobile app is the ability to trade anytime and anywhere, provided that users have an internet connection. This flexibility enables traders to respond to market changes rapidly, regardless of their location.

2. **Convenience**: Mobile apps grant users on-the-go access to their trading accounts, allowing them to execute trades, monitor positions, and analyze charts with ease. The convenience factor is especially significant for those who juggle trading with other responsibilities.

3. **Time Efficiency**: Mobile apps often feature one-click trading, allowing traders to open and close positions quickly, which can be vital in volatile market conditions.

4. **Learning Opportunities**: Many apps offer educational resources, including forex tutorials, webinars, and demos. These tools help new traders learn the ropes and develop their trading skills effectively.

Challenges and Considerations

Despite the many advantages, forex trading mobile apps come with some challenges that traders should be aware of:

1. **Technical Limitations**: While mobile apps are powerful, they can sometimes lack the full functionality of desktop platforms. Advanced charting options and complex analysis tools may be limited on mobile devices.

2. **Network Connectivity**: Successful trading requires a stable internet connection. Poor connectivity can lead to delays in executing trades, which may cause losses in a fast-moving market.

3. **Distraction and Impulse Trading**: The convenience of mobile apps can sometimes lead to impulse trading, where users make quick decisions without thorough analysis, potentially resulting in losses.

4. **Security Risks**: While mobile trading apps prioritize security, traders should still be vigilant. Using public Wi-Fi networks can expose sensitive information and increase the risk of unauthorized access.

Choosing the Right Forex Trading Mobile App

When selecting a forex trading mobile app, consider the following factors:

1. **Broker Reputation**: Choose an app from a reputable broker with a history of reliability, good customer service, and positive user reviews.

2. **Account Types**: Look for brokers that offer a range of account types to suit different trading strategies and experience levels.

3. **Fees and Commissions**: Understand the fee structure associated with the app, including spreads, commissions, and withdrawal fees, as these can impact your profitability.

4. **User Reviews**: Examine user reviews and ratings for the app to gauge customer satisfaction and reliability. This can provide insights into the app’s performance and feature set.

5. **Availability of Features**: Ensure the app includes essential features that align with your trading style, including customizable charting tools and alerts.

The Future of Forex Trading Mobile Apps

As technology continues to evolve, the future of forex trading mobile apps looks promising. Advancements in artificial intelligence (AI) and machine learning are likely to lead to the development of more sophisticated trading tools, automating analyses and enhancing decision-making processes. Additionally, the integration of social trading features could allow users to share strategies and insights, fostering a collaborative trading environment.

In conclusion, forex trading mobile apps have fundamentally changed the way traders interact with the currency market. The combination of accessibility, convenience, and robust tools makes these apps an essential component of modern trading. Whether you’re a novice just starting out or a seasoned trader, leveraging a mobile trading app can significantly enhance your trading experience and success.